Investment Thesis

Treating International Paper Company (NYSE:IP) as a standalone business, I would not consider it a wonderful business in the Buffett sense. Over the past decade, it had declining top and bottom lines with corresponding declining returns.

While it is a cash cow, it operates in a mature sector where it is difficult to deliver double-digit growth via organic growth. I guess that is why there is an interest in M&A in this sector.

My valuation of IP as a standalone business showed it is only worth USD 22 per share. The offer by Suzano rumoured to be for USD 42 per share would have been a good exit opportunity. Now that it is off the table, the value would depend on the synergy with DS Smith.

Thrust of my analysis

Over the past few months, we have read about the proposed combination of IP and DS Smith. There was also news that Suzano is in its talks with IP to acquire it, which could derail the DS Smith merger. The latest news is that Suzano has terminated its talk with IP.

While there are still potential moving parts, I want to take a stab at assessing the value of the IP and DS Smith combination. This is very similar to what I did for the merger of Smurfit Kappa Group and WestRock.

In this context, this is the first part of my series. This part looks at IP as a standalone business. In other words, what is the business value of IP if it continues to do what it had been doing for the past decade? You would consider this situation if the DS Smith combination does not go through.

The next step is to value DS Smith as a standalone business. To assess the value of the combined DS Smith and IP, I would then have to value it on the combined cash flow. These 2 are stories for another day.

Business background

Formed in 1898 as a pulp and paper group, IP is today a fiber-based packaging company with a small cellulose fiber operation. In 2023, the company reported its performance under the following segments:

- Industrial Packaging. This is a fiber-based packaging business with products such as corrugated packaging and containerboards.

- Global Cellulose Fiber. According to the company, this segment produces “quality pulp for a wide range of applications like diapers, and other personal care products that promote health and wellness.”

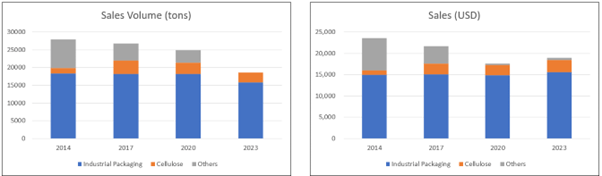

Before 2021, the company also had a Printing Paper segment, but this was spun off into a standalone public company. Given this, the sales volume and revenue of IP today are much smaller than those in 2014. Refer to Chart 1.

You can see the Industrial Packaging segment accounted for the majority of the sales volume and revenue. In 2023, this segment accounted for 86% of the sale volume and 82% of the dollar revenue.

Secondly, the cellulose business only became a significant one in 2017 following the acquisition of the Weyerhaeuser pulp business in Dec 2016.

Chart 1: Sales by segments (Author)

Notes to Chart 1:

1) Others included the Printing Paper segment and the Russian pulp and paper business.

2) The 2014 and 2017 segment results were estimated based on the 2020 segment breakdown provided in the Form 10k, and as such may not be fully similar to those in 2020 and 2023.

Although the company described itself as a global company, in 2023 the US accounted for 86% of its revenue. Europe, the Middle East, and Africa accounted for another 9% with the balance from other regions.

The key feature of IP was that over the past decade, there have been almost annual restructuring efforts that came from plant closures, divestments, and/or acquisitions.

IP operates in a mature market with a single-digit growth rate, as exemplified by the following:

“The U.S. fiber-based packaging market size was valued at USD 85.46 billion in 2022 and is expected to grow… at a CAGR of 3.90% from 2023 to 2032.” Precedence Research

“The USA and Canada molded fiber pulp packaging market is estimated to be valued at US$ 1.9 billion in 2023. It is expected to further expand at a CAGR of 5.2% in the next ten years between 2023 and 2033.” Future Market Insights

Operating trends

I am a long-term value investor and as such I prefer to “stand back” and look at the long performance. Chart 2 provides one such perspective.

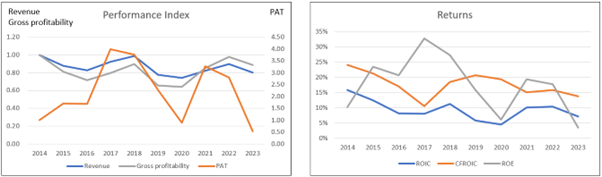

I have earlier stated that revenue declined over the past decade, partly due to the divestment of the printing paper business. This declining trend can be seen in the left part of Chart 2.

If you ignore the revenue from the Others (that included the printing paper business), the overall revenue from the Industrial Packaging and Global Cellulose Fiber segments only grew at 1.6% CAGR. There was hardly any revenue from the Industrial Packaging segment, with most of the growth coming from the Global Cellulose Fiber segment.

The other characteristic was that revenue and PAT were cyclical and volatile, with PAT being more volatile. PAT had a standard deviation of 123% compared to the 9% for revenue over the past decade.

- The jump in PAT in 2017 was due to USD 1.2 billion in tax benefits from cuts and Job Benefits.

- The decline in PAT in 2020 was COVID-19-related.

The other interesting characteristic was that PAT in 2023 was lower than that in 2014. You would have thought that the goal of the restructuring, divestments, and acquisitions was to grow profits and returns. Not only was profit lower, but we also had declining return trends, as illustrated in the right part of Chart 2.

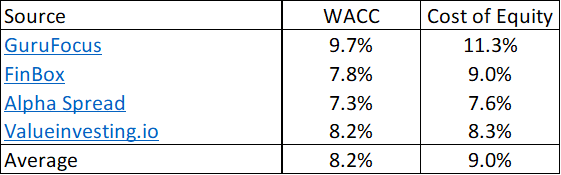

Despite the declining returns, IP managed to achieve an average ROIC and ROE of 9% and 18% respectively. These were higher than the current 8% WACC and 9% cost of equity, implying that shareholders’ value was created. But some would argue that part of the ROE came from the tax breaks and cannot be attributed to management efforts.

Chart 2 Performance Index and Returns (Author)

Productivity and efficiency

In its 2023 Annual Report, the company stated the following:

“Driving out costs across our operations was a primary focus throughout the year and by leveraging advanced technologies and big data, we continued to improve productivity and drive profitability.”

I must admit that I could not find supporting evidence for improving productivity and/or cost control.

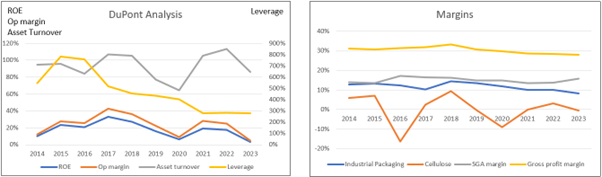

- There was no improvement in capital efficiency as measured by gross profitability (gross profits / total assets). Refer to the left part of Chart 1. This was supported by the declining gross profit margin. Refer to the right part of Chart 3.

- SGA margin got worse, from an average of 14% in 2013/14 to 15% in 2022/23.

- A DuPont Analysis of the ROE indicated that there was no discerning trend for the asset turnover. Refer to the left part of Chart 3.

- Total assets declined while equity grew, resulting in declining leverage as illustrated in the left part of Chart 3.

- The EBIT margins for its main segment (Industrial Packaging) were declining. Refer to the right part of Chart 3

This is not a wonderful company in the Buffett sense. There was hardly any revenue growth, the bottom line and returns declined, and there were no improvements in various operating metrics.

Chart 3: DuPont Analysis and Margins (Author)

Product prices

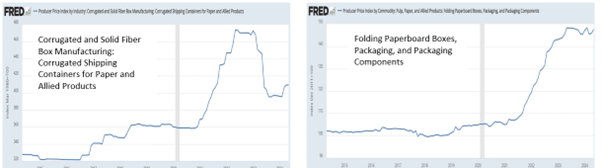

Chart 4 shows the FRED’s Producer Price Indices for some fiber-based packaging and other related products. While not exactly a 100% match for IP’s products, I hope it can provide some insights into IP product pricing risks.

You can see prices over the past 2 years were about 40% to 50% higher than those 7 or 8 years ago. Given this price picture, I posit that IP performance over the past year or so was externally driven.

Chart 4: Producer Price Index (FRED)

You can get a sense of the increasing average unit selling price by looking at Chart 1. Sales volume was decreasing for the Industrial Packaging and Global Cellulose Fiber segments. But there was hardly any dollar revenue growth. This meant that unit selling prices increased over the past decade.

Looking at the Product Price Index patterns, you must question whether the current price is sustainable.

Peer comparison

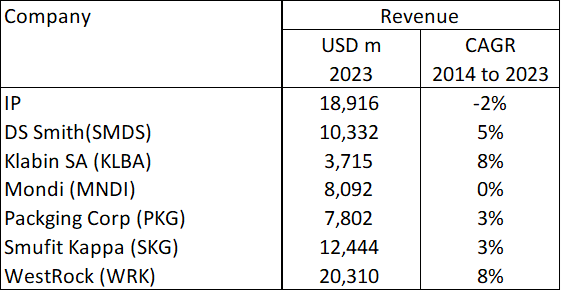

Table 1 compares IP revenue with those of its peers. You can see that IP is one of the bigger players among its peers. But it was the only one with a declining growth rate over the past decade.

Table 1: Peer Revenue (Author)

Note to Table 1: The peers were taken from IP Form 10k 2023

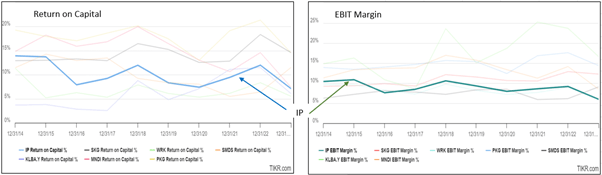

Apart from the declining growth, IP’s return on capital and EBIT margin trends were in the bottom half of the peers. Refer to Chart 5. I guess this supports my contention that this is not a wonderful company.

Chart 5: Peer comparison (Author)

Financial position

Notwithstanding its lackluster operating performance, I would rate IP as financially sound considering the following:

As of the end of Mar 2024,

- It had a debt-capital ratio of 38% compared to its 2016 high of 60%. According to the Damodaran Jan 2024 dataset, the US packaging and container sector had a debt-capital ratio of 38% while it was 27% for the paper and forest products sector.

- It had USD 1 billion cash, representing about 5% of its total assets.

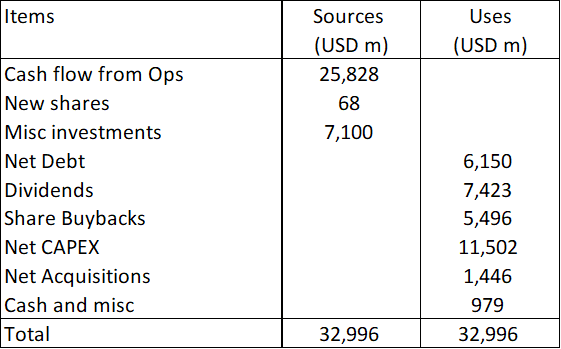

It also generated positive cash flow from operations every year over the past decade. During this period, it generated USD 25.8 billion in cash flow from operations, compared to the USD 11.8 billion PAT. This is a good cash conversion ratio.

IP had a low average Reinvestment rate of 17% over the past 10 years. This meant that a big part of the cash flow from operations could be returned to shareholders. I defined the Reinvestment rate as Reinvestment / NOPAT.

Reinvestment = Net CAPEX & Net Acquisition – Depreciation & Amortization + Increase in Net Working Capital.

Finally, IP had a good capital allocation track record. Refer to Table 2 where I have shown the sources and uses of funds from 2014 to 2023. IP was able to easily cover the CAPEX and acquisitions with the cash flow from operation. Excess was returned to shareholders as dividends and share buybacks.

Table 2: Sources and Uses of Funds 2014 to 2023 (Author)

Valuation

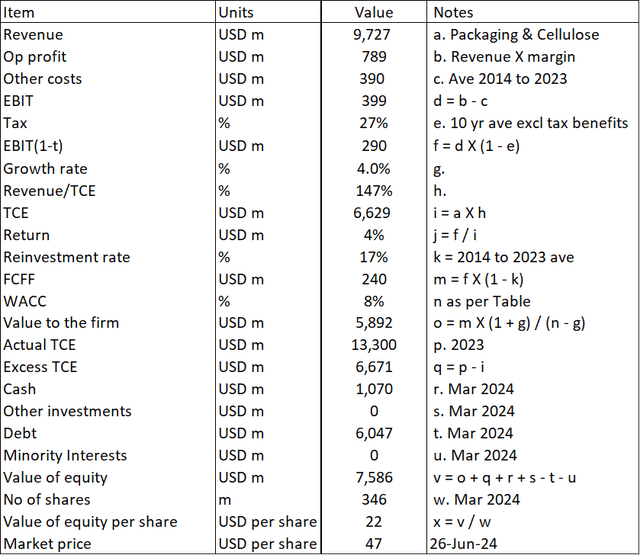

Moving forward, IP will have only the Industrial Packaging and Global Cellulose Fiber businesses. I thus projected the revenue and operating profit margins based on the past 3 years’ performance of these 2 segments.

For this article, I also assumed that there would not be any major acquisitions. In other words, I assumed that its acquisitions would be the “normal” that would result in a Reinvestment rate equal to its historical average of 17%.

As such, IP is not going to be a high-growth company. I thus assumed a 4% growth rate in perpetuity.

Based on the above assumptions, I estimated the intrinsic value of IP to be USD 22 per share compared to its market price of USD 47 per share (26 Jun 2024). This is not an investment opportunity.

Valuation model

The valuation is based on the single-stage Free Cash Flow to the Firm (“FCFF”) model, where:

Value to the Firm = FCFF X (1 + g) / (WACC – g).

FCFF = EBIT(1- t) X (1 – Reinvestment rate).

EBIT(1-t) was estimated based on operating profit = revenue X operating profit margin

The Reinvestment rate was based on the 17% historical rate.

Details of the computation are shown in Table 3.

The WACC was based on the first page results of the Google search for “IP WACC” as shown in Table 4.

Table 3: Valuation model (Author) Table 4: Cost of funds (Various)

Risks and limitations

There are 3 risks and/or limitations in my valuation:

- Acquisition

- Unit selling price

- Steady volume

I have assumed that IP would not be undertaking any major acquisition that would boost its revenue. I have not attempted to value IP with a major acquisition because it would depend on the acquisition price, the acquiree’s performance, and the types of synergies expected (e.g. market share or lower cost). The value of IP could be higher with acquisitions.

I have earlier shown that in the past 3 years, the FRED Producer Price Indices were 40% to 50% higher than those 7 to 8 years ago. In my valuation, I took the past 3 years’ revenue as the base, implying that there will not be any price decline. I think this is open to challenge.

In Chart 1, I have shown that IP has experienced declining sales volume. I have assumed that IP had managed to arrest this decline in my valuation. In its Q1 2024 presentation, IP showed declining volume when comparing the Q1 2024 EPS and adjusted EBIT with those for Q4 2023. Again, I think my assumption can be challenged.

Conclusion

I have shown that IP is not a wonderful company based on its historical performance. Despite its restructuring, divestments, and acquisitions, revenue and PAT in 2023 were lower than those in 2013. I also could not find any evidence of improving productivity.

But there are some positive points. It is financially sound, and I would consider it a cash cow. It managed to create shareholders’ value over the past decade when comparing its average returns with the current cost of funds. Of course, some would argue that part of the value created came from the tax breaks and, as such, cannot be credited to management efforts.

IP is in a mature sector, and most of the packaging companies that I had covered only achieved double-digit growth with major acquisitions. IP is in the same boat in that it is not likely to deliver double-digit growth via organic growth.

My valuation looking at IP as a standalone business (assuming no DS Smith combination) does not provide any margin of safety. I think that that market is pricing IP taking into account either the Suzano offer or the DS Smith deal.

Now that the Suzano offer is off, the next article with explore the value of the synergy with DS Smith.

But I will leave you with these questions.

- Given its lackluster performance, what makes you think that IP could extract synergy from DS?

- Would the DS Smith deal be just IP getting additional revenue rather than other synergies?

Read the full article here