The iShares Micro-Cap ETF (NYSEARCA:IWC) is likely the only true passive solution that provides consistent exposure to U.S. micro-cap stocks without the liquidity and capital risks typically associated with this market segment. It is important to acknowledge that in the asset management industry, this segment is not often discussed, nor is it a commonly recommended option by wealth advisors for retail investors. However, I believe that a well-diversified portfolio should include this segment, particularly if one is optimistic about U.S. economic growth.

I strongly believe that this sector is currently in a favorable economic and technical position. Recent data on the unemployment rate and the consistent decrease in the Consumer Price Index (CPI) index offer the Federal Reserve the rationale to consider lowering interest rates. This, in turn, could provide U.S. micro-cap companies with greater access to credit. Even though the risk of a recession might increase, I believe this should not deter investors from considering exposure to the U.S. micro-cap stock segment.

Why IWC

It’s quite simple: IWC is the most representative passive solution in the micro-cap market, and probably the only one that truly fits the bill. When we talk about micro-caps, in the strictest sense, we’re referring to publicly traded companies with relatively small market capitalizations, typically ranging from about $50 million to $600 million. This is not to be confused with “small caps.” For instance, the Russell 2000 isn’t a suitable benchmark for micro-caps because it represents a different market segment. The appropriate benchmark for IWC is the Russell Microcap Index, which this ETF has consistently tracked since 2005.

Peer analysis

It’s also worth noting that among its peers, IWC is the most expensive in terms of expense ratio.

IWC Peers (Seeking Alpha)

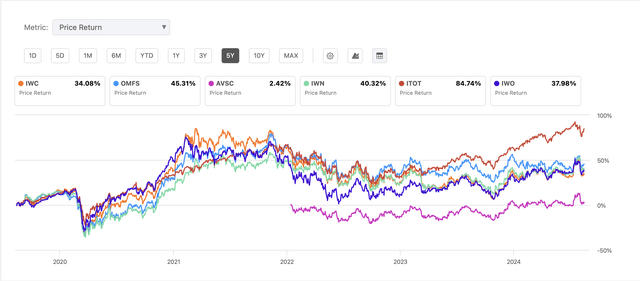

Indeed, the performance of IWC has been lower than that of other ETFs; over the past 5 years, it has underperformed ITOT, a passive fund that replicates the performance of the entire U.S. market.

Peer Performance (Seeking Alpha)

Despite this, I want to emphasize that only IWC provides investors with the opportunity to specifically target the U.S. micro-cap stock segment. It’s also important to note that most of the underperformance of this ETF began in 2022, when the Federal Reserve started raising interest rates in response to new inflationary pressures. The underperformance relative to its peers is not due to inefficiencies in the ETF’s composition or its higher expense ratio but rather is a result of broader macroeconomic factors. It is natural for this ETF to currently underperform its peers, but that doesn’t mean it lacks the potential to generate alpha in the future.

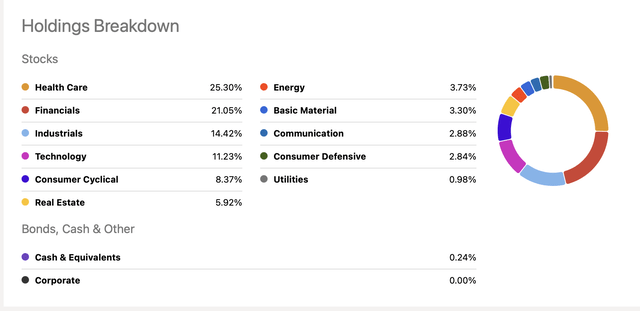

Holding breakdown

When discussing passive investment in micro-cap stocks, diversification is, in my opinion, extremely important. This is because we’re dealing with companies that have very small market capitalizations, typically ranging from $50 million to $600 million. As of 2024, speculative-grade companies, which often include many micro-cap stocks, are expected to have a default rate of around 4.5% to 4.9%.

Some of these companies may see explosive growth in their value, while others may unfortunately collapse. The IWC ETF, with its 1,462 holdings, offers incredible diversification, in my opinion. It provides the opportunity to expose our portfolio to the entire micro-cap market segment, allowing us to invest across the evergreen U.S. market while maintaining such a diversified structure.

Holding Breakdown (Seeking Alpha)

Why might this be a great time to invest in micro-caps?

The increase in interest rates has negatively impacted many market segments, and in my opinion, it has created numerous opportunities for those who have the patience to wait for the market cycle theory to take effect. One of the most affected segments is small and micro-cap stocks, primarily because, historically, when an increase in interest rates leads to an inversion of the yield curve, it often signals the start of a recession. Recessions do not favor the micro-cap segment, as these companies find it increasingly difficult to access credit, leading to a freeze in their business operations.

You might say now, “Hey, but after the recent unemployment rate data, the United States will likely fall into a recession.” First of all, the conclusion is not as straightforward as many tend to believe, and in my opinion, even Claudia Sahm has partly suggested that. Secondly, I believe that much of the recession risk is already priced into current micro-cap valuations, and this could lead to a significant decrease in interest rates, especially considering that the inflation rate has finally fallen below 3%. Therefore, I think it’s time to start looking towards a recovery.

I understand that finding interesting statistics about the micro-cap segment on the web is very difficult, and this makes fundamental analysis challenging. That’s why, in a portfolio overview, it could be interesting to start with a charting analysis.

Why consider investing in IWC?

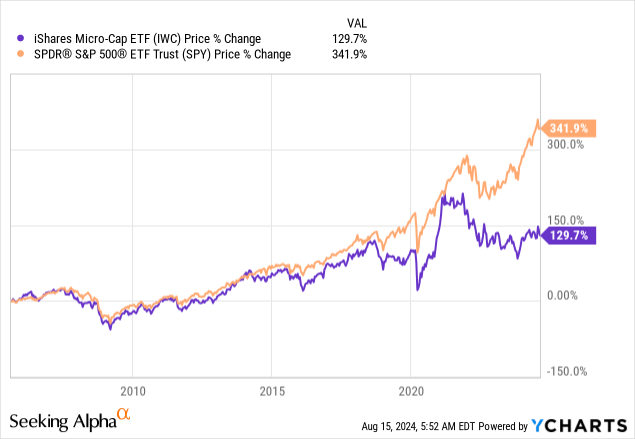

The spread between the SPDR S&P 500 ETF Trust (SPY) and IWC began to widen in 2018 when, for the first time in a decade, the Fed attempted to implement a tightening monetary policy. Since then, IWC has underperformed SPY. The annual percentage return of IWC is around 6%, which, I think, is not bad at all.

We need to keep in mind that a significant portion of this annual performance comes from sudden growth periods, during which there is good alpha relative to the broader market (S&P 500).

These growth periods usually occur in specific technical and macroeconomic contexts.

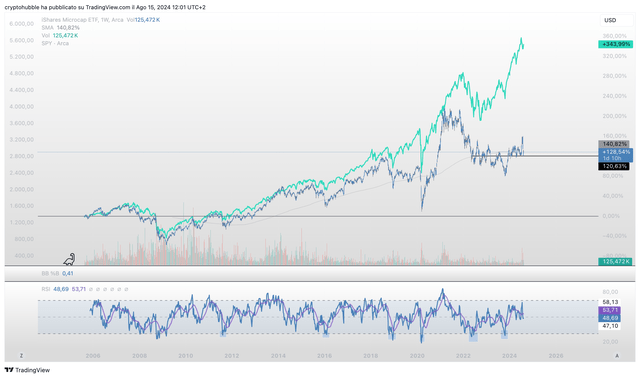

First of all, from a technical perspective: IWC has shown a strong uptrend since its inception, and historically, the RSI indicator’s lows have signaled good opportunities to start building a position in this ETF.

IWC-SPY Spread (TradingView)

This typically coincides with an upgrade in the overall market outlook, particularly when market liquidity increases, such as when the Federal Reserve adopts a more accommodative monetary policy, as seen in 2019 and 2020. Currently, while the broader market has increased in value due to upgraded profit margin projections driven by the AI boom, the small-cap and micro-cap markets continue to lag at lower prices due to poor financial conditions.

What could go wrong?

There is a risk, of course. The spread between the S&P 500 and IWC could decrease for another reason. An upcoming recession could lead to a significant reduction in the profit margins of big tech companies, which would cause a contraction in the S&P 500 index. However, we may not see a parallel increase in micro-cap stock prices, as that would be counterintuitive and without historical precedent. In this scenario, we might see a situation similar to the period between 2018 and 2020, when IWC underperformed SPY, and the pandemic disrupted market profit projections, leading to a downtrend in IWC as well.

Conclusion

To sum up, I believe this could be a good technical point to start a Dollar-Cost Averaging (DCA) plan in IWC. This approach would allow investors to participate in the potential rallies that typically characterize this stock market segment, which has historically shown cyclical patterns. For this reason, I confirm the hold rating for IWC.

Read the full article here