Investment Thesis

ASML Holding N.V. (NASDAQ:ASML) stock has rallied 40% YTD, largely driven by anticipated long-term higher demand for lithography systems amid the GenAI boom. As ASML exclusively manufactures EUV machines, the transition from the pre-EUV to the post-EUV in the semi industry will create a significant growth opportunity for the company. In 2019, EUV patterning technology was deployed for the mass production of 7nm chips. Now, the company is expected to introduce the first high-NA EUV, which is anticipated to support high-volume chips manufacturing in FY2025.

Despite a weak bookings result in 1Q FY2024 and a conservative earnings outlook, the management expects strong growth in FY2025. ASML is currently facing headwinds in revenue and margin contractions, particularly from China (account for 20% of total backlogs) due to export restrictions. Regarding the upcoming 2Q FY2024 earnings, my view remains muted. However, I will be focused on the details of the Taiwan Semiconductor Manufacturing Company Limited aka TSMC (TSM) deal in the next earnings call, which could potentially boost the company’s growth consensus for FY2025.

Due to the near-term sluggish growth, I have initiated a hold rating on ASML, as the stock is currently trading at a lofty valuation after the recent rally.

2Q FY2024 Preview: Focus on EUV

The company, which reports pre-market on Wednesday, July 17th, expects total net revenue of EUR 5.7 billion to EUR 6.2 billion in 2Q FY2024. The midpoint of that range implies a YoY growth of -13.8%, largely driven by continued headwinds in net bookings. Given EUR 3.6 billion of net bookings in 1Q FY2024, which was significantly below the market consensus of EUR 4.63 billion, I believe that management’s 2Q guidance is conservative. Additionally, a guided midpoint of 50.5% for the gross margin indicates further contraction on a QoQ basis. Based on the company’s 2Q FY2024 guidance, I calculated its EBIT margin to be 27.6% (my base case), showing a slight improvement from the last quarter. However, I will focus on the potential shift in management’s tone on its growth outlook, including growth headwind from China, rather than the 2Q earnings numbers, as they are likely not going to be great.

I believe the product revenue mix from EUV has been expanding and will become a key growth driver for ASML. In particular, the company is expected to sign a high-NA EUV machine deal with TSMC later this year.

The Size of the TSMC Deal Will Determine Its Growth Outlook in FY2025

The TSMC long-term agreement is expected to close in late FY2024, but the exact timing and details of the orders are still unknown. Each high-NA EUV machine costs around $380 million. These machines are expected to be delivered in FY2025, with the company aiming to achieve revenue goal between EUR 35 billion to EUR 40 billion, implying +30% YoY growth. ASML’s two biggest customers are TSMC and Intel (INTC). INTC placed orders from ASML in last December and mentioned in its recent earnings call that they rely on high-NA EUV for Intel 14A productions. They praised this technology for creating a strong tailwind for the company and expect it to significantly improve margins.

According to Bloomberg, this new machine can create semiconductor lines just 8nm thick, which is 1.7x smaller than the previous generation. TSMC is ASML’s biggest EUV customer, and I believe the order number in the deal will likely be higher than the market expected since TSMC has no other supplier and will focus on 2nm next year. The market expects the deal to be around EUR 4.5 billion. However, the recent rise in ASML’s stock price suggests this good news is largely priced in.

Expect Strong Growth on EUV in FY2025 and Beyond

In 1Q FY2024, the company’s net system bookings were EUR 3.6 billion, comprising 18.2% EUV bookings and 81.8% non-EUV bookings. Due to the current small weight of EUV bookings, the company’s total revenue growth won’t be significantly impacted by a potential reacceleration in EUV revenue growth in the near term. However, as its revenue mix gets larger, the stronger impact will kick in, though this process will take time, as implied by management. They forecasted that the company’s FY2024 total revenue is expected to be similar to 2023, indicating flat YoY growth. Meanwhile, I believe that the company’s margins may continue to deteriorate compared to last year due to weak top-line growth, largely impacting its earnings outlook. According to Seeking Alpha, ASML’s GAAP EPS is expected to decline by -5% YoY. Given the recent rally and higher multiples, it seems the market has looked past these near-term challenges.

Potential Uncertainty in China

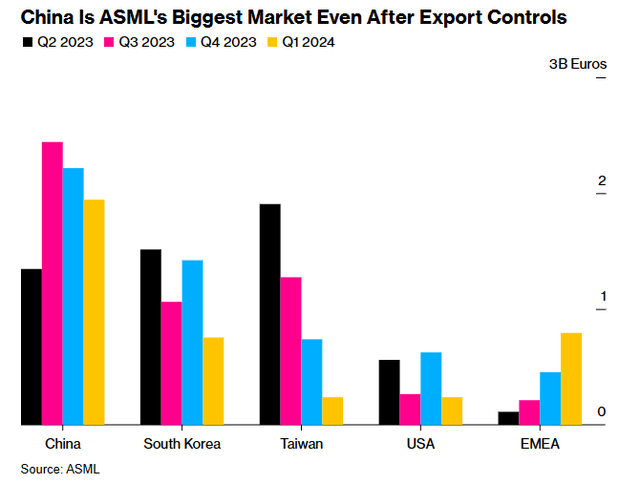

Bloomberg

ASML’s CFO previously indicated that around 20% of the company’s backlog comes from Chinese customers. In the last quarter, China included 49% of the company’s total system revenue. While the management expects a strong demand in the Chinese market in FY2024, the company is facing a growth slowdown. This is because U.S. government urged the Dutch government to introduce restrictions on exports of ASML’s DUV lithography machines to China from early this year.

In the recent earnings call, when an analyst asked about the current update on the Chinese market, ASML has reiterated 10% to 15% of China sales in FY2024 will be impacted by the export restrictions. Therefore, I believe that geopolitical tensions between U.S. and China could be a risk to impact the company’s growth outlook over the long run.

Valuation

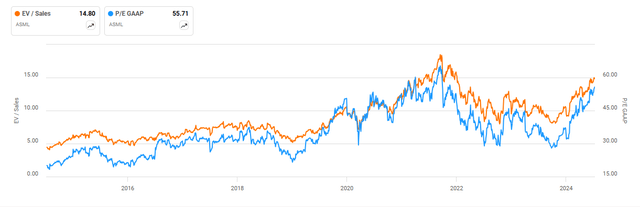

Seeking Alpha

Despite a deterioration in its fundamentals, the stock is currently trading at a lofty valuation due to a strong rally over the past year. Let’s look beyond FY2024 and focusing on the company’s growth outlook in FY2025, based on the high end of the company’s revenue target (EUR 40 billion), the stock’s EV/Sales FY2025 is 10.6x, which appears unattractive. Moreover, considering Seeking Alpha’s earnings consensus for FY2025, which implies a 56.1% YoY growth, its P/E FY2025 is 32.3x, slightly below the 34x of iShares Semiconductor ETF (SOXX)’s P/E TTM. However, we should know that 34x is based on a trilling twelve-month earnings result. This actually implies an even lower multiple in FY2025 for SOXX. Therefore, looking beyond ASML’s FY2024 growth outlook, I believe that the stock is currently fairly valued based on a broad-based premium valuation in the semi sector.

Conclusion

In sum, ASML faces short-term challenges in demand, but the company remains the sole provider of EUV lithography machines. Despite recent declines in revenue and margins, I’m cautiously optimistic about ASML’s growth outlook for FY2025, especially with expected sales of high-NA EUV machines to key customers like TSMC. This technology is crucial as semi manufacturers move towards smaller nodes, making ASML as a key player over the long term. However, growth slowdown in China, including geopolitical risks and export controls, could also pose long-term headwind.

Lastly, given the current valuation, I don’t find the stock very attractive for adding new positions at this price level. Therefore, I currently rate ASML Holding N.V. stock as a hold but anticipate a potential re-rating after 2Q FY2024 earnings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here