Introduction & Investment Thesis

DICK’S Sporting Goods (NYSE:DKS) is a leading sporting goods retailer that offers an extensive assortment of high-quality sports equipment, apparel, footwear, and accessories from national and vertical brands. The stock has outperformed the S&P 500 and Nasdaq 100 YTD.

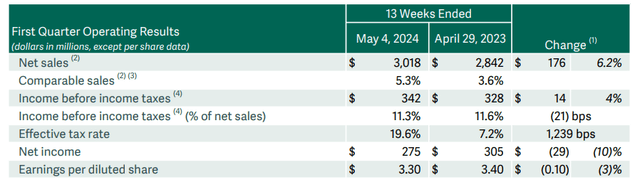

The company reported its Q1 FY24 earnings on May 29th, where it saw its revenues and earnings grow 6.2% and 4.2% YoY, respectively, as the company saw its customers, whom they refer to as “athletes,” increase their frequency of purchases as well as their average order values ((“AOVs”)). I believe this is driven by the management’s strategy to boost their athlete engagement by building its omnichannel strategy, whereby it opened two new House of Sport and 50K square foot DICK’S stores in Q1, coupled with improving their in-store experiences and driving personalized marketing content by leveraging their athlete database. At the same time, DICK’S continues to strengthen its relationships with its national and vertical brand partners to enhance their product pipeline.

For FY24, the management expects to grow their revenues by 1.6% to $13.2B while maintaining an Earnings before taxes ((“EBT”)) margin of 11.1%. Although I believe that the company will see its revenues grow in line with the nominal US GDP of 4% or higher in the coming years as it continues to scale its locations and boost customer engagement through a combination of its omnichannel strategy and building a differentiated product pipeline while growing its margins, it seems that its stock has currently priced in the upside.

Given the risk-reward, I will be staying on the sidelines and rating it a “hold” at its current levels.

The good: Strong revenue growth driven by higher purchase volume and AOV, coupled with consistent margins.

DICK’S Sporting Goods reported its Q1 FY24 earnings, where revenue grew 6.2% YoY to $3B, with comparable or same-store sales growing 5.3%, driven by increasing volume in transactions and AOVS, as the company continued to deliver on its strategic growth pillars of building an omnichannel athlete experience coupled with enhancing relationships with brand partners to grow its differentiated, on-trend product pipeline.

Q1 FY24 Earnings Release: Revenue and earnings growth

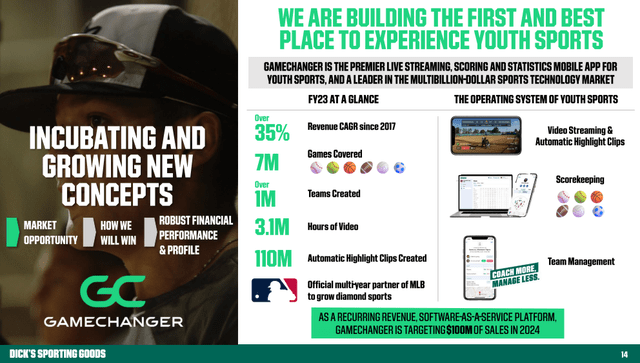

In terms of its omnichannel strategy, the company continued to boost its athlete engagement by enhancing service levels across their digital and store experiences, leading to customers shopping 2.7% more frequently and spending 2.6% more in AOV across footwear, athletic apparel, and hardline. During Q1, the company opened two House of Sport locations and two next-generation 50K-square-foot DICK’S locations. During the earnings call, Lauren Hobart, CEO of DICK’S, sounded optimistic in terms of results from these DICK’S concepts and outlined that they will be opening six and fourteen locations for House of Sports and Next Generation 50K square foot DICK’S stores throughout 2024, respectively. Meanwhile, the company is also heavily investing in leveraging their athlete database to create better in-store technology, such as Trackman Simulator and Showrunner Kiosk, while driving personalized marketing offers and content as part of their omnichannel strategy to improve the overall athlete experience and purchase confidence. Simultaneously, the company is also investing in Gamechanger, which is their live streaming, scoring, and statistics mobile app for youth sports. During Q1, 5M unique users spent on average 30 minutes per day on the app, and I believe that as the company continues to innovate within the youth sports market, it will strengthen their relationship with athletes and their families, leading to higher usage, allowing the company to reach its $100M in sales target in 2024.

May 2024 Investor Presentation: Gamechanger App

Turning our attention to the second growth strategy, DICK’S continues to strengthen their brand relations. During the earnings call, the management outlined that they will be bringing several breakthrough products across apparel and footwear that were highlighted at Nike’s Paris Innovation Summit. Plus, their vertical brands, which include DSG, CALIA, and VRST, are also growing at a faster rate than the total company comp growth, coupled with higher margins. I believe there is plenty of runway for growth in the vertical brands segment, given that it contributed 12% to Total Revenue in FY23, as it continues to unlock newer segments and drive sales growth through successful vertical brand partners.

May 2024 Investor Presentation: DICK’S network of national and vertical brand partners

Shifting gears to profitability, the company generated $342M in EBT on a GAAP basis, which represented a margin of 11.34%, a slight decline from a margin of 11.55% a year ago. This was driven by an increase in SG&A expenses, which included investments in their brand campaigns supporting CALIA, DSG, as well as Golf Galaxy and DICKS.com, coupled with higher compensation expenses associated with expanding their sales team and pre-opening expenses linked to Q1 House of Sport openings.

The bad: A macroeconomic slowdown can hurt DICK’S growth prospects as it increases its locations for House of Sport and 50K square foot DICK’S stores.

There is no doubt that DICK’S has been able to navigate an uncertain macroeconomic environment quite well so far. However, it is important to note that the future success of DICK’S is tightly correlated to the strength of consumer spending. As US consumers deplete their excess savings, coupled with record credit card debt in an environment where the Fed is keeping interest rates higher for longer, there is a growing probability of a macroeconomic slowdown in the US economy. Should we see a weakening in the US labor market, it will lead to a slowdown in consumer spending, which will hurt DICK’S growth prospects. At the same time, as the company continues to increase the number of locations for its House of Sport and 50K square foot DICK’S stores, I believe a slowdown in revenue growth from consumers cutting back on discretionary spending such as sporting goods will lead to a decline in the frequency and AOV of purchases, which will likely put downward pressure on margins and cash flows.

Tying it together: DICK’S is a “hold”.

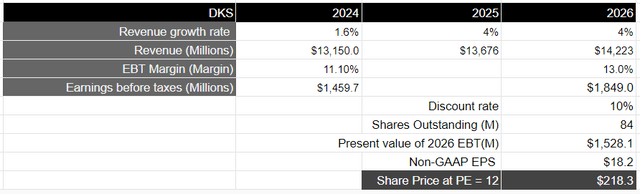

Looking forward, the company expects to generate $13.1-$13.2B in revenue in FY24, which represents a growth rate of 1.6% YoY. While this marks a slowdown in revenue growth from the previous year, I believe that it should go back to growing at par with the long-term nominal US GDP growth rate of 4%, which is a proxy for nominal consumer spending growth, as it continues to boost athlete engagement by driving its omnichannel strategy across its House of Sports and 50K square foot DICK’S stores, as well as its digital channels to increase purchase frequency and AOVs while strengthening its brand relations to build its on-trend and differentiated products. This would mean that DICK’S should produce a total revenue of at least $14.2B by FY26, assuming the US economy doesn’t tip into a major recession.

In terms of profitability, it should be able to grow its margins from its projected 11.1% in FY24 to at least 13%, as it benefits from growing economies of scale as its new House of Sport and 50K square foot DICK’S locations start to yield returns. This would translate to an EBT of at least $1.75B by FY26, which is equivalent to a present value of $1.5B when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that DICK’S should trade approximately 0.7x the multiple given the growth rate of its earnings. This will translate to a PE ratio of 12, or a price target of $218, which represents a downside of 3.4%.

Author’s Valuation Model

Although I am impressed by the management’s execution thus far in focusing its growth pillars around boosting the athlete experience by investing in building its omnichannel strategy while strengthening its brand relations to enhance its on-trend products, I believe that the upside is likely capped at current levels, even though the company declared a quarterly dividend of $1.10 per share, which would be equivalent to a dividend yield of 2.2%. With the growing risk of a possible slowdown in the US economy, which can trickle down to consumer discretionary spending in sporting goods, I believe the risk-reward doesn’t look attractive at the moment to initiate a position. Therefore, I will be staying on the sidelines and rating the stock a “hold” at the moment.

Conclusion

I believe that DICK’S upside is capped at its current levels. Although the management is optimistic about its growth pillars and continues to execute well as it expands its locations for House of Sport and 50K square foot DICK’S stores while strengthening its relationships with its brand partners, I believe the stock doesn’t look attractive from a risk-reward standpoint at its current levels.

Read the full article here