iShares MSCI France ETF (NYSEARCA:EWQ) is a popular way for investors to own some of the leading companies in France and get diversification and liquidity at the same time. This ETF has about $638 million in assets, and it has an expense ratio of 0.50%. It holds about 63 positions and has an SEC 30-day yield of nearly 2%. This ETF has performed well over the past several months (and past few years), and I think it is an ideal candidate to consider buying on pullbacks. The portfolio holdings are of such high quality, I would buy any of these stocks individually. However, it’s nice to have the diversification and all these great companies in just one ETF holding for my portfolio. Let’s take a closer look:

The Chart

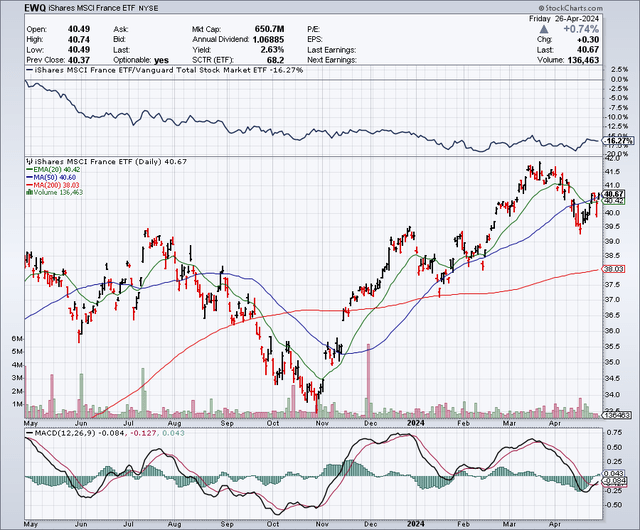

As the chart below shows, this ETF has been in an uptrend since late last year. In October 2023, this ETF was trading in the $33 range, but then went on to rally to over $41 per share in March 2024. This rally created a bullish “Golden Cross” formation on the chart in January 2024. The 50-day moving average is $40.60 and the 200-day moving average is $38.03. To buy or add to positions, I am looking for pullbacks that are close to or at the 200-day moving average, which tends to be a strong support level.

StockCharts.com

Top Holdings

This ETF holds some of the largest companies in France, which also happen to be industry leaders. Many of the companies below are globally dominant; let’s take a closer look at some of my favorite stocks in the portfolio:

LVMH Moët Hennessy – Louis Vuitton (OTCPK:LVMUY) is a top global brand for luxury goods. I think this stock is a great long-term holding, although it could decline if consumer demand for discretionary items falters in a recession. This stock represents about 11% of the portfolio.

TotalEnergies (TTE) is a global energy giant. This stock has been rising along with the price of oil, and yet, it remains deeply undervalued. It trades for a single digit price to earnings ratio, and it offers a yield of over 4%. I believe this stock has great potential for total returns between the dividend and stock price appreciation. This stock represents nearly 8% of the portfolio.

Airbus (OTCPK:EADSY) This maker of commercial planes has a major backlog of business thanks to demand for new aircraft. More airlines are looking to Airbus for new orders due to production issues at Boeing (BA). This stock represents about 5% of the portfolio.

L’Oreal (OTCPK:LRLCY) is the well-known French cosmetics giant that makes everything from skin cream to perfumes. This company might see consumers cut back on some items in a recession, but this company is probably poised to benefit from the long-term demand for skin care and for affordable luxuries such as self-care. This holding represents about 5.6% of the portfolio.

Seeking Alpha

ETF Performance

This ETF started on March 12, 1996, and it has provided average annual returns of about 7%. However, in recent years, the performance has been significantly higher. For example, the 1-year total return was 12.61%, the 3-year total return was 9.39% annually, and the 5 year was 10.03% annually.

Why Investing In France Makes Sense

1) France is one of the largest economies in Europe, and it has many dominant companies in various sectors, from luxury to energy and more. Economic activity is picking up in France, and it could be poised to accelerate going forward thanks to rate cuts and for other reasons.

2) France is going to hold the 2024 Summer Olympic Games in Paris from July 26 to August 11, 2024. This event will put the spotlight on France later this year and should be a boost for many of the largest French companies due to spending on everything from tourism to luxury goods.

3) Many investors, analysts and even sovereign wealth funds see France as an attractive country to invest in. Qatar recently announced it would invest $10 billion in French companies by 2030.

Rate Cuts Are Coming To Europe Soon

Inflation in the U.S. remains persistent, and the Federal Reserve seems to be pushing out the timeline for rate cuts. But things are going better in France. Inflation is easing in Europe and that is making the job of the European Central Bank or “ECB” easier. Rate cuts are expected in June, and there could be two or more rate cuts in total from the ECB in 2024. This could spur economic growth within the Eurozone, plus rate cuts make dividend stocks more attractive to investors and European stocks generally offer higher yields already, making them attractive for income investors.

Potential Downside Risks

France has had challenges with terrorism and protests, which can shut down basic services and transportation at times. Europe’s proximity to geopolitical hotspots such as the Middle East and Ukraine makes the Eurozone and France more potential downside impact if these conflicts escalate.

The Olympic Games could highlight France in a positive way if everything goes as planned; however, there is always a chance for unexpected problems, such as strikes, bad planning or other problems.

This ETF has rallied significantly off the lows it hit late last year. As such, there is already some good news priced into the holdings of this fund. It could be prone to pullbacks due to profit-taking or negative headlines, and this could be a downside risk to consider.

There are currency risks to consider when investing in foreign stocks. Currency exchange can impact the financials for these French companies, but it can also impact the value of French stocks, so this is another potential downside risk to consider.

In Summary

This ETF has provided solid long-term results. The holdings of this ETF are very high-quality companies that in many cases are dominant in key industries ranging from luxury to energy to aviation. The companies held in this ETF are likely to continue to grow steadily over time. The dividend yield of nearly 2% will add to the total shareholder returns, but I am mostly expecting capital gains. I am planning to add on pullbacks, especially around the 200-day moving average of roughly $38, or below.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here