In February of this year, we published an article on Nubank (NYSE:NU) titled: “Nubank: Bet Big On Latin America With This Fintech Monster”.

The core of the article was focused on NU’s incredible LTV/CAC ratio, asset light business model, and demographic tailwinds in the region. Add these up, we thought, and the path to profitability and an even more premium valuation appeared clear.

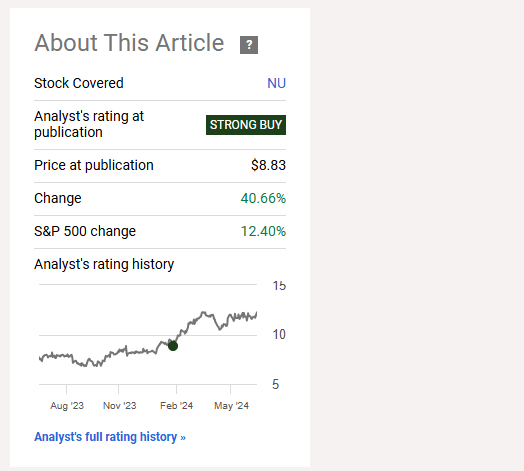

Fast-forward to the present, and our thesis has proven out to be largely correct. The stock is up about ~41% from where we rated it a ‘Strong Buy’, which has trounced the S&P 500’s return over that same period of ~12%:

Seeking Alpha

Despite this appreciation, we think the stock actually still has considerable upside as a result of accelerating net income growth, solid monetization trends, and potential multiple expansion.

Today, we’ll re-iterate our thesis, cover updates that have happened since our initial coverage, and touch on why we still think shares are ultimately a ‘Strong Buy’.

Sound good? Let’s dive in.

Our Original NU Thesis

In case you missed our first article, we like NU for a couple of reasons.

First off, the bank is a hard-charging entrant to the historically stagnant banking market in Brazil. This gives the company a very different cost structure to the traditional, oligopoly banks that have existed up to this point, like Itaú (ITUB).

A lower cost of servicing customers, based on a digital-first strategy, means that NU has been able to undercut competitors on pricing and fees. These lower fees, when combined with the premium digital experience, have led to incredibly strong CX, and thus, brand, among the Brazilian populace.

Word of mouth has been a huge acquisition channel for the company, and when combined with a monetization ladder that’s just beginning to filter through, by cohort, NU’s resulting LTV/CAC is incredible.

This means that the bank can make way more money per unit of spend than almost anyone. This approach has caught the big incumbent banks flat-footed, and now more than 50% of Brazilian adults have an account. Nearly 60% of those adults consider NU to be their ‘primary’ bank.

Between the brand, cost structure, and improving monetization, the company has a solid track record of success that management has recently been looking to replicate in other countries like Mexico and Colombia.

Secondly, demographic and digitization trends in the region are strong, which should serve to bolster onboarding and usage. While some individuals still prefer going into a physical bank, a digital-only approach has only recently become viable. Tailwinds towards digitization are only improving, which should power NU’s growth. Plus, over the long term, Latam has stronger fertility rates than most other geos, which should prevent demographic collapse concerns present in other developed markets.

Finally, on a valuation basis, the company is trading at a nominally ‘expensive’ ~6x sales (when compared to other financial companies), but the growth and margins of NU more closely mirror a fintech startup, which means that, in our view, NU’s stock price is mostly warranted / reasonable.

NU Updates

So – the company is working from a strong base.

However, recently NU released Q1 ’24 earnings, which have driven us to update our view on the stock today.

First and foremost, the report was very strong on both top and bottom-line results, with huge top-line growth of more than 69% YoY. This is extremely impressive, and shows how NU’s ‘land and expand’ business model works to first capture, then grow revenues on a per-customer basis. Again, these results come on the heels of a strong brand tailwind that pushes CAC down considerably.

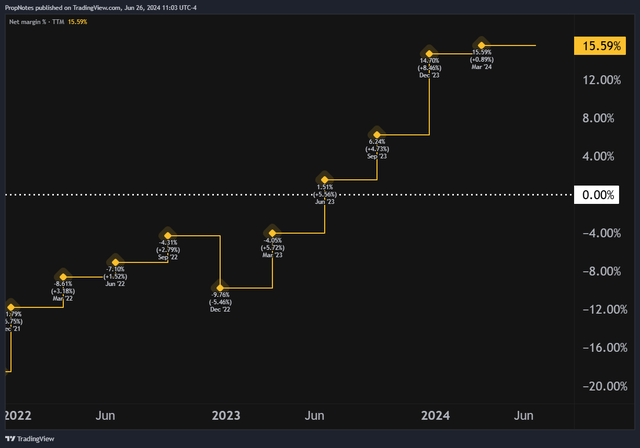

On the net income front, things have been growing even more quickly. Adjusted net income for Q1 came in at 442 million, which, on a sales base of $2.73 billion, implies a net margin of 16%.

Growth wise, adjusted net income YoY has come from $187 million to the $442 million figure, which implies income growth of more than 135%, which is extremely impressive.

Because net income is growing more quickly than revenues, it indicates that margins have been growing substantially over the last few quarters, cementing NU’s overall profitability inflection:

TradingView

It looks like this level of profitability is here to stay, and even potentially grow a bit more over the coming years.

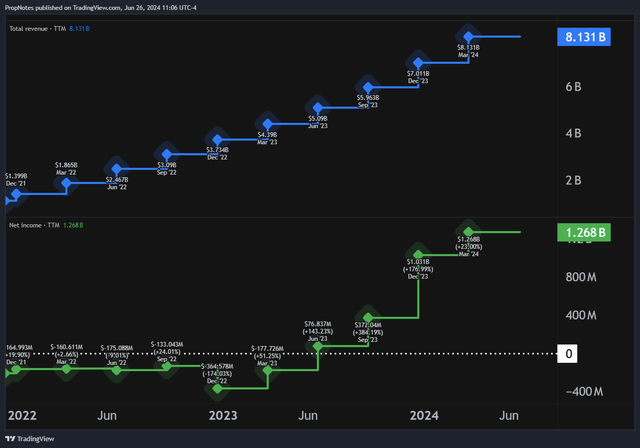

Zooming out a bit, you can also see this accelerating net income growth in the green line below:

TradingView

Top-line results are expanding as expected, but this TTM net income growth acceleration is really what has us excited.

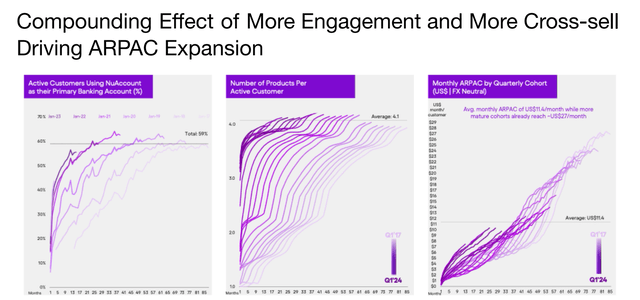

Powering this success are big strides in deeper monetization and new geographies.

On the monetization side, new product adoption is accelerating, which shows just how strong NU’s offer is to consumers, in addition to how quickly new customers are expanding product use:

Nubank

This data is incredibly bullish for the company, and is responsible for a good chunk of the profit growth we’ve seen so far in 2024.

On the new geographies side, the company also notched a big win, with 1.6 million in net adds for the quarter in Mexico, a huge growth geo for the company:

The sequential acceleration of customer net-adds in Mexico, amounting to nearly 1.5 million in the quarter, contributed to a total of 6.6 million at quarter-end. This highlights the success of Nu’s pricing strategy following the launch of Cuenta in Mexico, affirming the effectiveness of the playbook for driving accelerated customer expansion.

In other words, the NU playbook has shown that it is working in Mexico, which, to us, was one of the largest questions surrounding the stock. Now, with green shoots in this (and other) geos like Colombia, we think that the perceived risk of execution in all of Latam has decreased substantially.

This should contribute to the company’s financials over time as the TAM gets bigger, but it should also impact the company’s premium from a valuation perspective.

Valuation

As the company’s expansion efforts appear to be paying off, we believe that the premium the stock has enjoyed so far may actually not be enough when it comes to the level of potential future growth and profitability exhibited by NU.

Right now, on a sales basis, NU trades at about a 6.8x sales multiple. This is much, much more expensive than other banks, given that the average financials stock in the U.S. trades at roughly 2.2x sales.

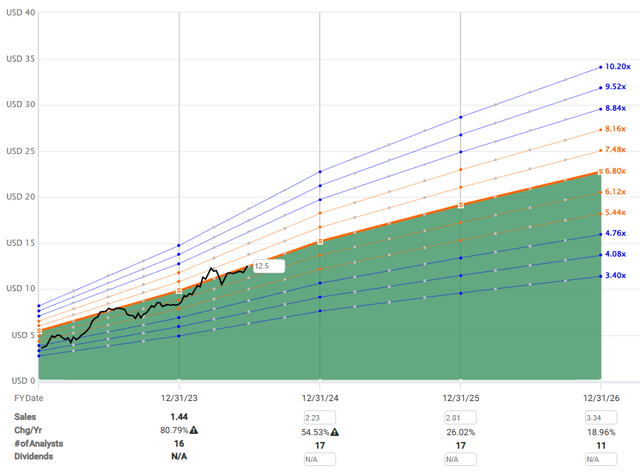

This 6.8x multiple is actually more in line with high growth tech companies, which appears more fitting given NU’s financial profile:

FAST Graphs

For us, if we’re looking at ‘fair value’ for NU’s stock, on the low side, it’s probably worth about $15, and about $18 on the high side, one year out, as you can see above. This range bakes in some room in the multiple on either side should things continue as they’re going now.

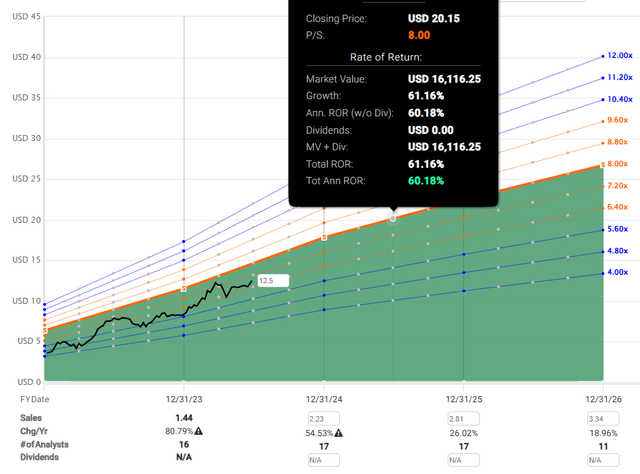

However, over the long term, we think it’s possible that NU’s multiple could expand to 8x sales on average, which would imply a price of about $20 as of mid-2025:

FAST Graphs

Thus, given the stock price right now around $12.50 per share, we see upside towards the $18-$20 range over the next twelve months, which would represent upside of 40%-60%.

In our view, it’s challenging to find another stock that we have this level of conviction on over the next year. There are names that we see having more potential upside, but none that we have as high a conviction on as NU.

Risks

That said, as always, there are some risks to be aware of.

First off, the bank does business in FX, and bringing these profits ‘home’ to U.S. investors may be challenging if the USD remains strong or strengthens. Currency headwinds like these could crop up and stifle profit growth, which would impact the stock.

Additionally, the somewhat nominally expensive multiple could prove to be an issue in a downturn. If investors sour on ‘expensive’ companies, like they did in 2022, then NU could see a material decline in the share price, even if the company’s underlying results continue to improve.

Finally, there’s always a level of execution risk that you take when investing in a company. If NU stops growing or producing the results that they have shown in their track record so far, management may become hard to trust, which would likely impact the stock materially to the downside.

Summary

That said, while there are some risks to be aware of, ultimately, we’re bullish on this impressive, world-class fintech company.

It’s growing like a weed, churning out profit, and shares could see additional upside through margin expansion, as well as organic financial growth over the coming year or two.

To us, it remains a ‘Strong Buy’.

Cheers!

Read the full article here